Smooth transactions fuel the engine of any online business. But with an array of payment processing solutions available, choosing the right one can be daunting. Payment gateways and payment aggregators are the two pillars of online payment processing.While their names may be tossed around interchangeably, they differ significantly in functionality and use cases. Let’s delve deeper to understand these differences and help you make an informed decision.

Unveiling the Payment Gateway

A payment gateway acts as a secure bridge between your customer’s bank and your website or app. Imagine it as a trusted intermediary that facilitates the flow of payment information for smooth transaction processing. Here’s what a payment gateway typically does:

- Transaction Authorization: It verifies the customer’s payment channel details (e.g., credit card & debit card information, UPI id, wallets) and ensures sufficient funds for the purchase.

- Data Encryption: This vital step safeguards sensitive data like credit card numbers by employing robust TLS encryption techniques.

- Transaction Processing: The gateway communicates with the issuing bank (customer’s bank) to authorize the transaction.

- Settlement: Once authorized, funds are transferred from the customer’s account to yours, usually within 1-2 business days.

Types of Payment Gateways

These gateways can be categorized based on their integration methods and service offerings:

- Hosted Payment Gateways: These redirect customers to the gateway’s secure page for payment processing. Examples include UPI payment standards. While offering simplicity and security, they may sacrifice some brand consistency for the customer.

- Self-Hosted Payment Gateways: Platforms like Stripe and Braintree allow data collection on your website before sending it to the gateway. This grants you more control but requires stricter security compliance.

- API/Non-Hosted Payment Gateways: Solutions like Authorize.Net offer seamless integration through APIs, giving you complete control over the payment experience. This is ideal for advanced e-commerce websites.

- Local Bank Integration Gateways: Gateways like CCAvenue (in India) connect directly with local banks, providing localized payment options. This benefits businesses targeting specific regions.

The Power of Payment Aggregators

Payment aggregators simplify the online payment process for businesses. Unlike gateways, they eliminate the need for a separate merchant account. Instead, you leverage the aggregator’s established account to accept payments from various sources like credit cards, debit cards, wallets, and UPI. Here’s what a payment aggregator offers:

- Onboarding and Merchant Management: Aggregators streamline the setup process, enabling you to start accepting payments quickly without dealing with individual merchant accounts.

- Transaction Processing: They handle the collection of payments from various sources and channel them efficiently into your account.

- Fund Settlement: Aggregators manage the settlement process, ensuring you receive payments after deducting any fees.

- Risk Management: They provide safeguards against fraud, handle chargebacks, and ensure compliance with regulatory standards.

- Multi-Channel Integration: This allows you to offer a unified platform for various payment methods, streamlining the checkout experience for customers.

Types of Payment Aggregators

Payment aggregators can be classified according to their services and payment options:

- Full-Service Payment Aggregators: Razorpay and Stripe are examples. They provide a comprehensive suite of payment methods and handle the entire payment process, from initiation to settlement.

- Niche Payment Aggregators: PayPal is a prime example, focusing on specific regions or methods like cross-border payments or peer-to-peer transfers. They cater to specific industries or transaction types.

- Mobile Payment Aggregators: Google Pay and Paytm specialize in mobile-based payments, integrating mobile wallets and offering QR code-based options for a user-friendly experience.

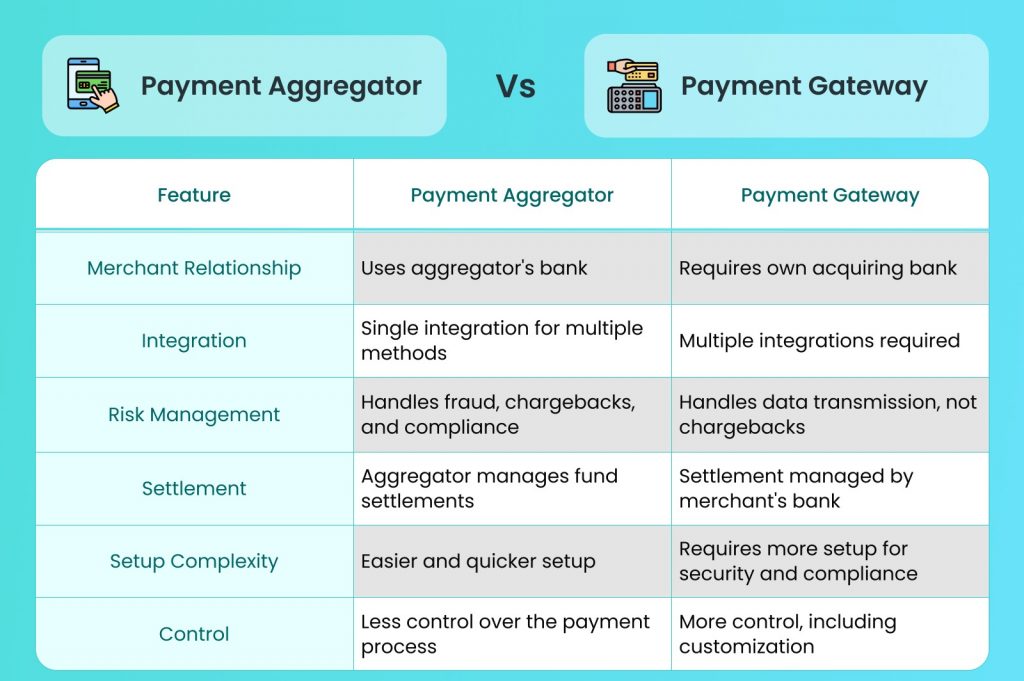

Choosing The Right : Payment Gateways Vs Payment Aggregators

Now that we understand their unique functionalities, let’s explore which solution best suits your business needs

When to Choose a Payment Gateway

- Established Businesses: High-volume businesses may find payment gateways more cost-effective in the long run.

- Customization Needs: Businesses requiring a high degree of control over the payment process, such as custom checkout pages or specific fraud prevention measures, will benefit from a payment gateway.

- Direct Merchant Account: If direct control of your merchant account is a priority, a payment gateway is the best choice.

When to Choose a Payment Aggregator

- Startups and SMEs: If you’re just starting out or running a small to medium-sized enterprise, a payment aggregator offers an easier and quicker setup.

Read Also: Simplify MSME Business Partner/Merchant Onboarding and Verification with Gridlines API

- Low Transaction Volume: For businesses with fewer transactions, payment aggregators offer a more appealing option due to their simplicity and adaptability, even if they charge higher per-transaction fees.

- Diverse Payment Methods: If you aim to provide customers with a variety of payment options without managing multiple integrations, a payment aggregator is an excellent choice.

Conclusion

The decision between payment gateways vs payment aggregators hinges on your business’s size, specific requirements, and future growth aspirations. Payment gateways often provide greater control and potentially lower costs for businesses handling a high volume of transactions. In contrast, payment aggregators offer a more streamlined and adaptable solution for smaller businesses or those starting out as they require a minimal amount for setup.

Key Takeaways

- Payment gateways are ideal for businesses seeking greater control, customization, and potentially lower fees for high-volume transactions.

- Payment aggregators are suitable for startups, SMEs, or businesses with lower transaction volumes, offering simplicity, flexibility, and a wide range of payment options.

By understanding the key differences and considering your business’s unique requirements, you can select the payment solution that best aligns with your goals and facilitates seamless transactions for your customers.

Leave a Reply