In today’s digital economy, speed is currency — but trust is the foundation. As financial services, HR platforms, marketplaces, and even healthcare providers race to digitize, two forces are quietly shaping the future: FinTech and RegTech.

FinTech builds the rails for faster, smarter financial experiences. RegTech ensures those rails are safe, compliant, and regulator-ready. One drives innovation. The other enforces accountability. Increasingly, they’re not just coexisting — they’re converging.

This article breaks down what RegTech really is, how it differs from FinTech, why their integration is mission-critical, and how it plays out across industries.

What Is RegTech?

RegTech — short for Regulatory Technology — is the infrastructure that helps businesses stay compliant without slowing down. It automates identity checks, monitors risk, and keeps audit trails clean — all in real time.

In a world where regulations shift faster than most teams can adapt, RegTech turns compliance from a bottleneck into a business enabler.

What Is FinTech?

FinTech, or Financial Technology, is the innovation engine of modern finance. It powers everything from mobile wallets and peer-to-peer lending to embedded payments and robo-advisors.

FinTech platforms are built for speed, scale, and user experience. But with innovation comes exposure — to fraud, data misuse, and regulatory scrutiny. That’s where Regulatory technology steps in.

RegTech vs FinTech: A Strategic Contrast

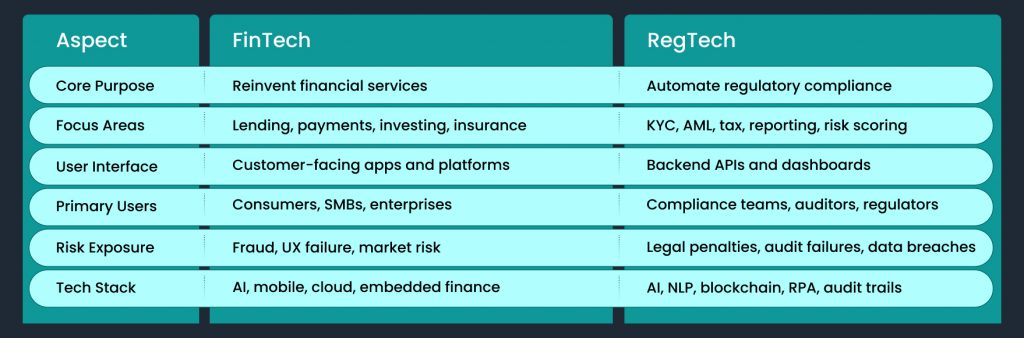

While both are technology-driven, RegTech and FinTech serve fundamentally different — yet complementary — purposes.

FinTech builds the product. RegTech ensures it’s compliant, secure, and scalable.

Why FinTech Needs RegTech

FinTech moves fast. Regulators don’t. That tension creates risk — especially when platforms onboard users in seconds, issue loans in minutes, and operate across jurisdictions.

Without RegTech, FinTech platforms face:

- Delayed onboarding due to manual KYC checks

- Compliance gaps that trigger fines or shutdowns

- Data privacy violations under laws like GDPR or DPDP

- Loss of trust from users, partners, and regulators

It solves these by embedding compliance into the product journey. It turns verification, reporting, and monitoring into real-time, invisible workflows — without compromising speed or UX.

In short, RegTech is the safety layer that allows FinTech to scale responsibly.

Why RegTech Needs FinTech

It isn’t just a support function. It thrives when integrated into high-volume, high-risk environments — exactly where FinTech operates.

FinTech platforms generate the data RegTech needs to:

- Train risk models

- Monitor behavioral anomalies

- Validate credentials and transactions

- Build predictive compliance dashboards

FinTech provides the use cases. Regulatory technology provides the guardrails. Together, they create a feedback loop where innovation and governance reinforce each other.

As FinTech expands into embedded finance, crypto, and cross-border payments, Regulatory technology becomes the only way to maintain trust at scale.

Technologies That Power

It isn’t one tool — it’s a stack. Here’s what drives it:

- Artificial Intelligence (AI): Detects anomalies, flags suspicious behavior, and predicts compliance risks

- Natural Language Processing (NLP): Parses legal documents and regulatory updates to auto-adjust policies

- APIs & Microservices: Enable real-time verification of identities, tax IDs, and licenses

- Blockchain: Creates immutable audit trails and ensures data integrity

- Robotic Process Automation (RPA): Automates repetitive tasks like data entry and report generation

- Cloud Infrastructure: Scales compliance across geographies and business units

Where RegTech Shows Up: Use Cases Across Industries

The convergence of RegTech and FinTech is already reshaping operations across sectors. Here’s how it plays out:

Banking & Lending

- FinTech: Instant credit decisions, digital onboarding, mobile-first lending

- RegTech: Real-time identity verification, automated credit bureau pulls, AML screening

- Impact: Reduced onboarding time, lower fraud risk, full RBI and DPDP compliance

HR Tech & Workforce Platforms

- FinTech: Salary advances, embedded insurance, payroll-linked lending

- RegTech: Employee verification, GST/PAN validation, consent-based background checks

- Impact: Faster onboarding, verified gig workforce, audit-ready HR operations

E-commerce & Marketplaces

- FinTech: Instant seller payouts, embedded credit, dynamic pricing

- RegTech: Supplier KYC, GST validation, invoice compliance

- Impact: Scalable seller onboarding, reduced fraud, tax compliance across states

Insurance & InsurTech

- FinTech: Instant policy issuance, embedded coverage, claims automation

- RegTech: ID/license verification, IRDAI compliance, fraud detection

- Impact: Faster claims, lower risk, regulator-ready operations

Healthcare & HealthTech

- FinTech: Digital health wallets, embedded financing, telemedicine payments

- RegTech: HIPAA/DPDP compliance, consent-based data sharing, credential verification

- Impact: Patient trust, secure data handling, reduced liability

Logistics & Supply Chain

- FinTech: Embedded payments, dynamic pricing, fleet financing

- RegTech: Driver/license verification, GST validation, transport compliance

- Impact: Verified partners, reduced fraud, seamless cross-border operations

The Road Ahead: Trust by Design

The future isn’t FinTech versus RegTech. It’s FinTech with RegTech — embedded, invisible, and indispensable.

As platforms scale across borders, handle sensitive data, and operate in real time, compliance can no longer be an afterthought. It must be built into the product journey — verifying identities in seconds, monitoring transactions continuously, and generating audit trails automatically.

This isn’t just about avoiding penalties. It’s about earning trust at scale. Platforms that unify innovation and governance don’t just move fast — they move confidently.

FinTech builds the future of finance. Regulatory technology ensures that the future is sustainable, secure, and regulator-ready. One without the other is a liability.

If you’re building or positioning a solution like Gridlines, this is your edge: You’re not offering APIs. You’re delivering trust infrastructure — the foundation for compliant growth, embedded verification, and frictionless scale.

Let’s turn that into a campaign, a product story, or a category-defining message. Ready when you are.

Leave a Reply