The deadline to link your Aadhaar with PAN has been a pressing concern for millions of Indians, given the vital role this linkage plays in personal finance, tax filing, and verification processes. If you’ve already initiated the process, your next question might be: “How do I check my Aadhaar-PAN link status?” Thankfully, the steps are straightforward and accessible, whether you’re tech-savvy or prefer more traditional methods. This guide will take you through the need-to-know details for checking your Aadhaar-PAN link status, why it’s important, and what you can do if there’s a discrepancy.

Why is linking Aadhaar and PAN essential?

The government mandates linking Aadhaar with PAN as a measure to simplify income tax processes, prevent tax evasion, and streamline identification for various financial transactions. PAN (Permanent Account Number) is a unique identifier issued by the Income Tax Department and is necessary for filing income tax returns. Aadhaar, issued by the Unique Identification Authority of India (UIDAI), serves as a unique proof of identity for residents across the country. Linking these two ensures that all financial transactions can be easily monitored, reducing fraudulent practices and enhancing transparency. Moreover, failing to link these documents can lead to penalties, account freezes, or delays in financial transactions.

Simple steps to check your Aadhaar PAN link status

Checking the status of your Aadhaar-PAN link is a quick process and can be done both online and offline.

Method 1: Check online via the Income Tax department’s website

The Income Tax Department has made it easy to verify your Aadhaar-PAN link status directly through their official website. Here’s how:

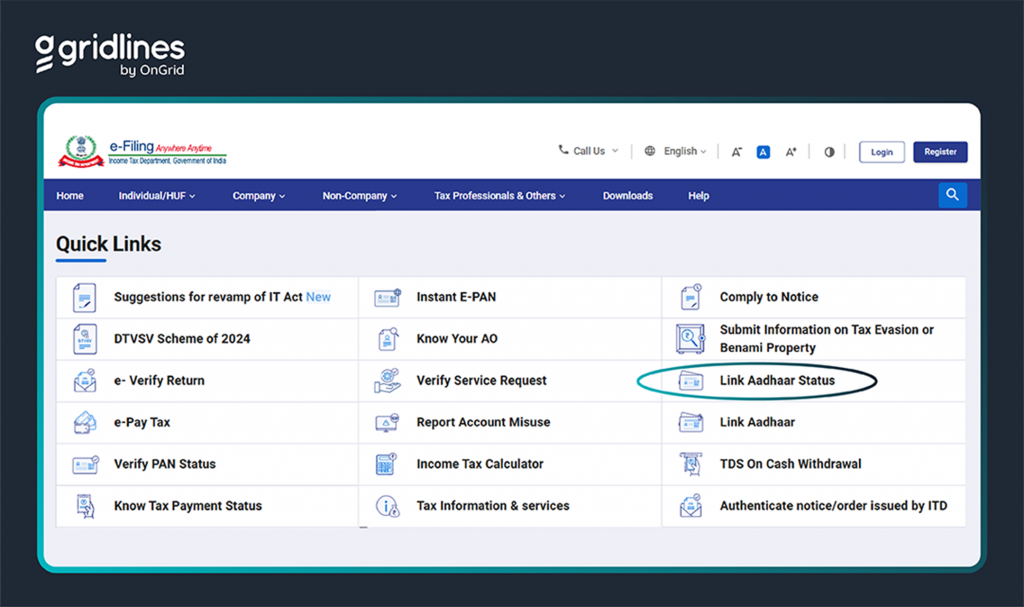

1. Visit the Income Tax e-Filing website: Go to https://www.incometax.gov.in and look for the option to check your Aadhaar-PAN link status.

2. Navigate to the ‘Link Aadhaar Status’ section: You’ll find a specific option titled “Link Aadhaar Status.” This is generally located under the “Quick Links” section on the homepage.

3. Enter your Aadhaar and PAN details: Once on the status page, input your Aadhaar number and PAN. Double-check the details to avoid any errors.

4. Submit and check status: After submitting, you’ll see an update on your screen about the status of your Aadhaar-PAN linkage. The system will notify you if the two are already linked or if there’s an action pending on your part.

Method 2: Check Via SMS

For those who find the online method challenging or prefer a quicker alternative, you can check your Aadhaar-PAN link status via SMS:

1. Open the SMS application on your mobile: From any registered mobile number, open your SMS app.

2. Type the message in the prescribed format: Type UIDPAN (space) followed by your 12-digit Aadhaar number, another space, and then your 10-digit PAN.

3. Send the Message to 567678 or 56161: Once sent, you’ll receive a message indicating the status of your Aadhaar-PAN linkage.

How to link Aadhaar with PAN if not yet linked

If you discover that your Aadhaar and PAN are not yet linked, you’ll want to complete the process promptly to avoid any issues with your financial or tax-related activities.

Online linking through the Income Tax website

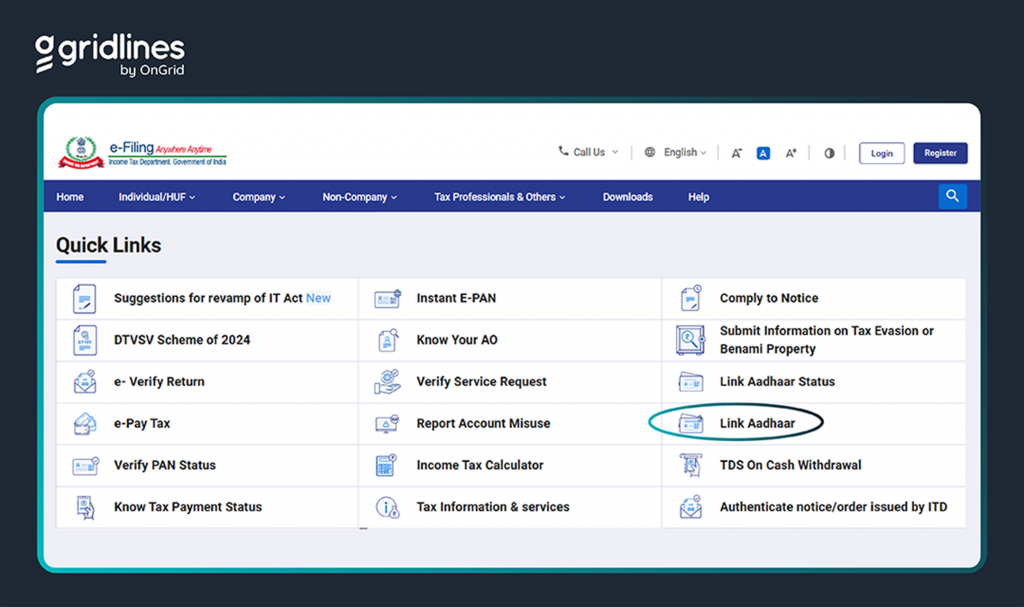

1. Go to the e-Filing Portal: Visit the Income Tax Department’s website https://www.incometax.gov.in.

2. Click on ‘Link Aadhaar’: Locate the “Link Aadhaar” option, generally accessible on the homepage.

3. Enter details: Fill in your PAN, Aadhaar number, and your name as per your Aadhaar card. You may also be required to enter a CAPTCHA code.

4. Confirm and link: After confirming all details are correct, click on “Link Aadhaar.” You may need to validate this action with an OTP sent to your registered mobile number.

Offline linking by visiting a PAN service centre

If you prefer an in-person approach, you can visit a nearby PAN service centre. There, you can request a form for linking Aadhaar with PAN, fill out the necessary information, and submit your form along with copies of your PAN and Aadhaar cards. A small fee may apply for offline linking, but this method is a good option for those who may be unfamiliar with online processes.

Common issues and troubleshooting for Aadhaar-PAN linkage

During the Aadhaar-PAN linking process, a few common issues may arise. Here’s how to tackle them:

1. Name mismatch: Sometimes, the name on your PAN card may not match exactly with your Aadhaar, leading to errors in linking. In such cases, consider updating either document to ensure consistency. Minor spelling variations can typically be resolved by validating with an OTP, but major differences may require official updates.

2. Date of Birth discrepancy: Discrepancies in your date of birth across the two documents can cause verification failures. Ensure both your Aadhaar and PAN have the correct birthdate. You may need to update one document if there’s a significant mismatch.

3. Invalid mobile number or email linked to Aadhaar: If your mobile number or email linked to Aadhaar is outdated, you may not receive OTPs required for linking. In this case, visit an Aadhaar enrollment centre to update your contact information.

4. Technical issues on the portal: Occasionally, high traffic or system maintenance can cause delays or errors on the Income Tax e-filing website. If you encounter issues, try checking back later or using the SMS method.

Why staying updated on Aadhaar PAN link status matters

The linkage of Aadhaar and PAN is crucial not only for tax filing but also for securing various financial benefits. In addition, the Aadhaar-PAN linkage strengthens identity verification processes, reducing the risk of fraud and unauthorised transactions. For individuals, it eliminates multiple identity submissions, making verification processes seamless and ensuring compliance with government regulations. Furthermore, failure to link Aadhaar and PAN by specified deadlines can lead to penalties, so it’s essential to stay on top of your linkage status to avoid these risks.

The Aadhaar-PAN linkage is a necessary step toward building a secure and transparent financial system. Regularly checking your Aadhaar-PAN link status will keep you informed and help you avoid any last-minute issues during tax season. With both online and offline methods available, tracking your status has never been easier. Whether you’re accessing the Income Tax portal or simply sending an SMS, staying updated ensures you’re prepared, compliant, and equipped for seamless financial and verification transactions in the future.

Take a few minutes to check your Aadhaar-PAN link status today—you’ll have peace of mind knowing everything’s in order, avoiding unwanted complications down the road.

Leave a Reply