What is Financial Literacy and Why Is It Important in India?

Financial literacy refers to the ability to understand and effectively use various financial skills, including budgeting, saving, investing, credit management, and financial planning.

In India, where digital banking, UPI payments, credit products, and online investments are exploding, financial literacy is no longer optional—it’s essential for:

- Avoiding debt traps

- Securing long-term savings

- Protecting oneself from online scams

- Making informed investment decisions

- Accessing financial products responsibly

Read More: RBI’s Push for Real-Time Credit Reporting

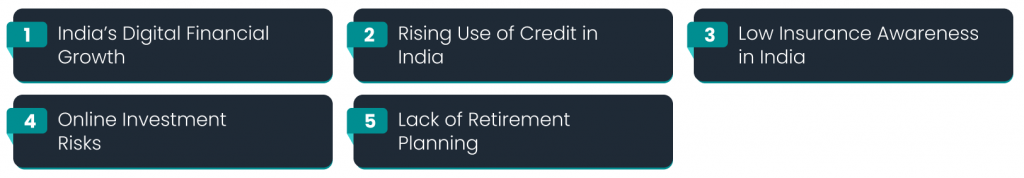

Why Is Financial Literacy Important in 2025?

1. India’s Digital Financial Growth

With more than 800 million internet users, India is the world’s largest real-time payment market. UPI, digital wallets, and fintech apps have brought millions into the financial system. But without literacy, this access can lead to uninformed decisions and misuse.

2. Rising Use of Credit in India

From credit cards and EMIs to Buy Now Pay Later (BNPL) services, personal credit in India is growing rapidly. However, many users are unaware of interest rates, penalties, or credit score impact.

RBI data (2024) shows increased default rates, especially among young consumers taking unsecured loans.

3. Low Insurance Awareness in India

Despite government-backed insurance schemes, insurance penetration remains under 5% of GDP in India. Many Indians lack awareness about health, life, and term insurance, putting families at risk.

4. Online Investment Risks

From unregulated crypto schemes to stock tips from social media influencers, Indian investors face rising exposure to financial scams.

SEBI has flagged multiple social media-based financial advisory scams in the last two years.

5. Lack of Retirement Planning

With rising healthcare costs and life expectancy, Indians can no longer rely solely on family support or EPF. Yet, most do not plan for retirement early enough due to lack of understanding of SIPs, mutual funds, and pension schemes.

How Does Financial Literacy Help India?

A financially literate India means:

- Higher savings rate

- Lower NPAs (bad loans) in banks

- Wider insurance adoption

- Greater participation in formal credit and investments

- Reduced dependence on informal lenders

- Lower economic vulnerability to scams and fraud

Governments Goal

The National Strategy for Financial Education (NSFE 2020-2025) aims to improve financial literacy for 500 million Indians through education, access, and inclusion.

Who Is Responsible for Promoting Financial Literacy in India?

Government Initiatives

- RBI Financial Literacy Week

- NCFE (National Centre for Financial Education) programs

- PM Jan Dhan Yojana (PMJDY): Over 500 million bank accounts opened

- SEBI Investor Awareness Programs

Private Sector

- Banks and fintechs offering in-app learning modules

- Financial influencers and content creators educating youth

- Employers launching financial wellness programs

Educational Institutions

Schools and colleges are slowly integrating basic financial concepts into curriculum, especially through NEP 2020 recommendations.

How Can You Improve Your Financial Literacy in India?

Step-by-Step Guide

- Track your spending: Use budget apps like Walnut or Google Sheets

- Learn how credit works: Understand credit scores (CIBIL), loan EMI structure, and repayment terms

- Start saving with SIPs: Mutual funds offer long-term wealth creation via small monthly savings

- Protect with insurance: Use IRDAI-approved term insurance and health plans

- Verify before you invest: Always check SEBI registration for advisors and platforms

- Read and follow: Use RBI, SEBI, and NCFE websites; follow trusted Indian finance educators on YouTube

Financial Literacy in Rural India

Access to formal finance is growing in rural India, but literacy levels remain low. SHGs (Self-Help Groups), women entrepreneurs, and small farmers often lack the tools to manage credit, insurance, or digital banking.

Programs like Digital Saksharta Abhiyan (DISHA) and NABARD’s Financial Literacy Initiatives are helping bridge the rural-urban gap, but scale and consistency remain key challenges.

Common Questions About Financial Literacy in India (FAQs)

Q1. Why is financial literacy important in India?

Financial literacy helps Indians manage money, avoid frauds, and make informed decisions about loans, savings, and investments, especially as digital finance becomes more accessible.

Q2. How can I improve my financial literacy for free?

You can use:

- RBI’s Money Kumar series (available in regional languages)

- SEBI’s investor education portal

- NCFE e-learning modules

- Free YouTube channels like CA Rachana Ranade or Invest Aaj for Kal

Q3. How does financial literacy prevent scams?

Understanding how interest, debt, and investments work helps individuals recognize fake schemes, Ponzi scams, and misleading offers before they cause harm.

Q4. What age should financial literacy begin?

Ideally from school age. Basic concepts like saving, budgeting, and understanding money should start by age 10. This builds better habits and smarter adults.

Q5. Can financial literacy help improve my credit score?

Yes. Understanding how credit utilization, repayment history, and inquiries impact your CIBIL or Experian score enables better credit behavior.

Conclusion

In a rapidly digitizing and credit-driven economy like India, financial literacy is the new essential skill, as important as reading or writing. It empowers individuals, strengthens families, and secures national growth. And unlike most things in finance, it costs nothing to start.

Leave a Reply