KYC — Know Your Customer — stopped being a checkbox long ago. Today it’s a trust engine: the process that helps businesses verify who their customers really are while reducing fraud, meeting compliance and smoothing onboarding. “KYC as a Service” (KYCaaS) is the cloud-native, on-demand version of that engine. Instead of building expensive verification pipelines in-house, companies subscribe to platforms that perform identity checks, document verification, biometric matching, sanctions screening and more — all via managed services and integrations. This post explains what KYCaaS does, the features that matter, why businesses adopt it, and where the market is headed.

What KYC as a Service actually does

At its core, KYCaaS shifts the heavy lifting of identity verification to specialized providers. These platforms typically offer:

- Digital identity proofing — Matching a person to an identity using documents (passports, driver’s licenses), government databases, or digital identifiers (mobile, email).

- Document verification — Scanning and validating ID documents for authenticity using OCR, MRZ checks and forgery detection.

- Biometric checks — Face match and liveness detection to ensure the presenter is the real person behind the document.

- AML & watchlist screening — Screening against sanctions lists, PEPs (politically exposed persons) and adverse media to meet anti-money laundering requirements.

- Data enrichment — Adding signals such as device intelligence, phone and email risk scores, or address history to improve confidence.

- Risk scoring & orchestration — Producing a single risk verdict or score and providing workflow rules for automation, escalation, or manual review.

- APIs and pre-built widgets — Easy integration into web and mobile flows, SDKs and hosted flows for quick deployment.

- Audit trails and reporting — Immutable logs, consent records, and exportable reports to satisfy regulators and auditors.

KYCaaS can be offered in modular form — pick only document checks, or combine biometrics + AML screening — or as an end-to-end turnkey flow. That flexibility is a major reason businesses prefer it.

Key features to look for in a KYCaaS provider

Not all KYC services are created equal. When evaluating providers, consider these features:

- Accuracy and fraud detection: Good providers use multi-layered signals (document forensic checks, device & network telemetry, biometric liveness) to distinguish sophisticated fraud from legitimate customers.

- Global coverage: If you operate across borders, the provider must support the ID documents, languages and watchlists relevant to your markets.

- Low-latency user flows: Fast checks and smooth UIs reduce drop-offs in onboarding. Hosted SDKs and mobile-optimized capture are crucial.

- Configurable risk rules: The ability to tune thresholds and workflows per geography, product line, or customer segment keeps verification proportional and cost-efficient.

- Privacy and data residency: Support for regional data residency, clear data retention controls, and strong encryption practices must be non-negotiable.

- Auditability & compliance: Detailed logs, consent receipts and standard reports make regulatory audits far less painful.

- Developer experience: Clean APIs, sample code, sandbox environments and good documentation shorten time-to-market.

- Human-in-the-loop support: AI is strong but not perfect — accessible manual review queues and expert adjudicators reduce false positives.

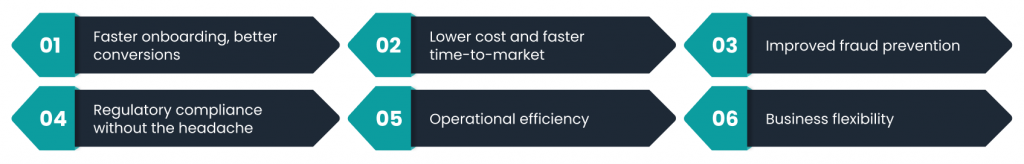

Concrete benefits for businesses

Adopting KYCaaS brings immediate operational and strategic advantages:

- Faster onboarding, better conversions: Removing friction from identity checks — while keeping risk controls intact — increases completed signups and reduces abandonment.

- Lower cost and faster time-to-market: Using a provider avoids building costly verification systems, maintaining data integrations, and hiring specialists. You pay for a service that scales.

- Improved fraud prevention: Providers continuously update fraud models and share signals across clients, giving you protection that would be hard to replicate internally.

- Regulatory compliance without the headache: KYCaaS vendors keep pace with changing compliance requirements and maintain audit-ready records, reducing legal exposure.

- Operational efficiency: Automated triage and risk scoring reduce manual review volumes, letting compliance teams focus on true exceptions.

- Business flexibility: Launch new products or enter new countries faster by plugging into a provider with broad, pre-existing capabilities.

Trade-offs and risks to manage

KYCaaS is powerful, but it’s not a silver bullet. Teams must be mindful of:

- Vendor lock-in: Relying on a single provider for identity-critical services introduces dependence. Design integration layers so you can swap providers if needed.

- Data privacy and sovereignty: Sending customer identity data to a third party requires robust contracts and attention to local privacy laws.

- Over-reliance on automation: Too-strict automated rules can hurt genuine customers (false positives). Strike a balance with manual review and appeal paths.

- Cost at scale: Per-check pricing can add up. Use risk-based flows — only run the most expensive checks when needed.

Real-world use cases

KYC as a service finds applications across industries:

- Neobanks and fintechs: Real-time identity proofing for instant account opening and payments.

- Marketplaces & gig platforms: Verifying sellers, drivers, or service providers quickly to reduce operational risk and build trust.

- Gaming & gambling: Age verification and AML checks to comply with strict regulations.

- Telehealth and online pharmacies: Confirming identities before controlled substance prescriptions or sensitive consultations.

- Enterprise onboarding: Pre-offer BGV (background verification) and contractor checks as part of HR workflows.

Future trends — where KYCaaS is heading

The KYC landscape is evolving fast. Watch for these trends:

- Passwordless and decentralized identity: Self-sovereign identity (SSI) and verifiable credentials will let users present attestations issued by trusted parties. KYCaaS providers will need to validate and accept these new identity artifacts.

- Privacy-preserving verification: Techniques like zero-knowledge proofs and selective disclosure enable proving identity attributes (e.g., “over 18”) without revealing full documents — a win for user privacy.

- Composable identity stacks: Customers will increasingly mix services — identity wallets, data brokers, AML screening and document checks — assembled through orchestration layers. KYCaaS will become more about interoperability and orchestration than monolithic features.

- AI-driven risk models: Expect continuous learning models that combine device signals, behavior, and network intelligence for adaptive screening — but paired with explainability to satisfy auditors.

- Regtech convergence: KYC will fold into broader compliance platforms that handle transaction monitoring, sanctions screening and case management in unified workflows.

- Frictionless biometrics: Liveness and biometric verification will become less intrusive and more accurate, enabling rapid, confident identity proofing on mobile devices.

- Regulatory standardization: As digital identity matures, we may see more harmonized rules and accepted standards across regions — simplifying cross-border onboarding.

Final note — think of KYC as an experience, not a gate

The best KYC implementations treat verification as part of a user’s journey, not an obstacle. KYC as a service gives businesses the tools to verify responsibly while preserving the human experience: fast, private, and respectful. That balance — stringent enough to deter fraud, gentle enough to welcome real users — is the fundamental design challenge of identity today. Choose technology that’s accurate, configurable, and accountable; combine it with clear communication and accessible remediation for customers; and you won’t just check regulatory boxes — you’ll build trust, which is the real currency in the digital economy.

Leave a Reply