A large number of startups and internet platforms distribute their products and services through a network of Merchants, Business Entities, and Micro, Small, and Medium Enterprises (MSMEs). In the fast-paced world of business, a smooth and efficient onboarding process for business partners and merchants is crucial.

Also read : Stop Guessing, Start Connecting with Address Lookup by Mobile API

Gridlines APIs offer a comprehensive solution to enhance your onboarding process, providing safer, faster, and smarter verification of MSMEs, business vendors, merchants, etc.

Why Gridlines for MSME or Merchant Verification?

Eliminate Risks of Onboarding Fraudulent Entities

By leveraging the power of Gridlines APIs, you can mitigate the risks associated with onboarding fraudulent entities. The comprehensive verification process helps you weed out unscrupulous entities and merchants, and ensure the integrity of your business ecosystem.

Faster Onboarding, Instant Verification

Gridlines APIs provide real-time verification, allowing you to validate the legitimacy of SMEs or merchants immediately. Gridlines APIs enable swift onboarding procedures, ensuring that your business can onboard new business entities or merchants with minimal delays. The seamless integration of Gridlines APIs into your existing systems ensures a quick and hassle-free onboarding experience.

Seamless Plug & Play Integration

Integrating Gridlines APIs into your onboarding process is a breeze. With its plug-and-play functionality, you can effortlessly incorporate the APIs into your existing systems, saving time and effort on implementation.

Data Privacy and Regulation

Gridlines API prioritizes data privacy and compliance with regulatory requirements. Along with that, API output information about your business partners (which may also include sensitive information) is NOT stored by us after the verification transaction. We understand and respect that this is essential to ensuring data protection and compliance.

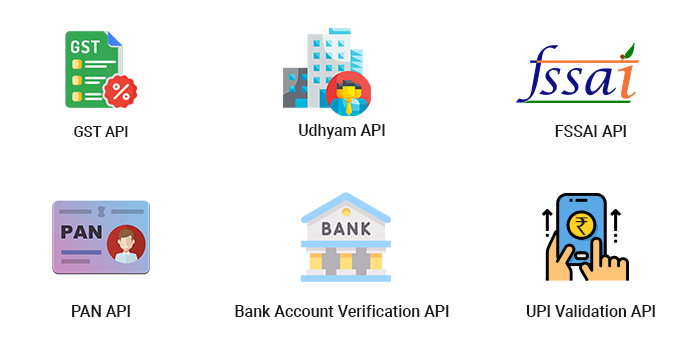

Recommended APIs for MSME, Vendor, or Merchant Onboarding:

GST Verification API

By using the GSTIN (Goods and Services Tax Identification Number) verification API, you can identify and vet entities you are conducting business with. The GST API provides valuable information such as validity, status, PAN (Permanent Account Number), legal and trade name, type of company, address, phone, email, directors, and aggregator turnover.

Input to API: GSTIN

Udyam and Udyog Aadhaar Verification APIs

The Udyam and Udyog Aadhaar verification API leverages the unique IDs assigned to entities that have completed their MSME registration, that entails the issuance of the Udyam registration number and Udyog Aadhaar number. The APIs provide essential details such as the name of the entity, major activity, organization type, mobile, email, address, and date of incorporation.

Input to APIs: Udyam registration number, Udyog Aadhaar number

FSSAI Verification API

For businesses that are either restaurants (or food trucks), cafes or engaged in food business, the Food Safety and Standards Authority of India (FSSAI) verification API offers real-time verification of FSSAI license numbers. This verification ensures the legitimacy and certification of restaurant partners and food businesses. Output Information provided includes company name, license type, validity status, address, product, and business type.

Input to API: FSSAI Licence Number

PAN Verification API

Like every individual, every business or MSME is also issued a PAN number. The PAN verification API allows you to verify PAN numbers issued by the Income Tax Department. This verification can be performed at the time of onboarding a business partner and provides details such as legal entity name, date of incorporation, category (category C means company, category P means individual), state, city, pincode, etc.

Input to API: PAN Number

Bank Account Verification API

To ensure the legitimacy and validity of business entity bank accounts (so that your payments to your vendor or MSME business partners do not fail), Gridlines APIs offer a Bank Account Verification API. By inputting the bank account number, you can retrieve information such as the account holder’s name, bank name, branch name, city, MICR (Magnetic Ink Character Recognition) code, etc.

Input to API: Bank Account Number, IFSC Code

UPI Validation API

For businesses utilizing UPI (Unified Payments Interface) for transactions, the UPI Validation API provides the means to verify the legitimacy and validity of UPI IDs. The API can validate the UPI ID and retrieve information such as the name of the account holder, status, and validity.

Input to API: UPI ID

There are several other APIs (variants of GST and PAN APIs, Director Verification, CIN Verification, and DIN Verification) that can be used to onboard and verify businesses for your platform or business ecosystem.

Take advantage of Gridlines APIs today to simplify your business partner/merchant onboarding process and ensure the legitimacy of your vendors and business partners. To get Gridlines’ sandbox access, sign-up here. To know about OnGrid and Gridlines’ 100+ APIs and verification services, write to partner@ongrid.in.

FAQs

Q1. What is Gridlines, and how does it help in onboarding MSMEs or merchants?

Gridlines is a verification API suite by OnGrid that helps businesses verify the identity and legitimacy of MSMEs, vendors, and merchants. It offers instant, secure APIs like GST, PAN, Udyam, FSSAI, and bank verification to enable faster and safer onboarding.

Q2. How do Gridlines APIs help prevent fraud during merchant onboarding?

Gridlines APIs validate multiple data points—GSTIN, PAN, Udyam number, FSSAI license, bank details, etc.—to ensure that the onboarding entity is legitimate, registered, and compliant. This significantly reduces the chances of onboarding fraudulent or fake entities.

Q3. Can I integrate these APIs into my existing onboarding platform?

Yes, Gridlines APIs offer plug-and-play integration, allowing you to easily connect them to your current systems with minimal development effort.

Q4. What types of businesses or platforms can benefit from these verification APIs?

Any business that partners with MSMEs, vendors, or merchants—such as e-commerce platforms, food delivery apps, fintechs, SaaS providers, logistics companies, and marketplaces—can benefit from these APIs.

Q5. How fast is the verification process using Gridlines APIs?

Gridlines APIs provide real-time verification, allowing you to instantly validate the entity’s credentials and move forward with onboarding without delays.

Leave a Reply